The writing is on the wall for Chief Financial Officers. Like it or not, most organizations are demanding business process

320w, http://blog.docuware.com/hs-fs/hub/388534/file-2159539234-jpg/digital_accounting.jpg?t=1489434989070&width=480&name=digital_accounting.jpg 480w, http://blog.docuware.com/hs-fs/hub/388534/file-2159539234-jpg/digital_accounting.jpg?t=1489434989070&width=640&name=digital_accounting.jpg 640w, http://blog.docuware.com/hs-fs/hub/388534/file-2159539234-jpg/digital_accounting.jpg?t=1489434989070&width=800&name=digital_accounting.jpg 800w, http://blog.docuware.com/hs-fs/hub/388534/file-2159539234-jpg/digital_accounting.jpg?t=1489434989070&width=960&name=digital_accounting.jpg 960w" sizes="(max-width: 320px) 100vw, 320px"/>transformation in accounting and finance, and a new role for finance leaders. According to the American Productivity and Quality Center (APQC), nearly 3 in 4 organizations have an active financial process transformation project underway.

For many CFOs, this demand for automated accounting processes represents an enormous opportunity. This is an opportunity to not only dramatically improve operations and reduce costs (a traditional role for the CFO), but to also leverage this experience to become the hub for digital business process transformation initiatives throughout the organization. In other words, embracing change can create long-term benefits for both the CFO and the organization. It can position the CFO as a powerful force in the broader corporate objective of digital transformation and business process transformation.

Bottom performers spend an average of $.64 per $1,000 in revenues on financial reporting; top performers spend only $.11 (source: APQC). So clearly the imperative to improve financial performance is serious. But in a world of a thousand and one priorities, where should you start?

Take Control Today: Download "9 Ways to Reduce Costs in Your Accounting Processes"

As you think about automated accounting processes, where are the most significant opportunities? Here are 4 suggestions:

1. Accounts payable process/accounts receivable (AP/AR)

According to APQC, there is a wide variety of efficiency in invoice management. Consider how top organizations perform relative to those on the bottom, and consider the day in and day out impact this has on overall business efficiency, costs, and productivity.

|

Bottom performers |

Top performers | |

|

Cost per invoice processed |

$12.50 |

$5.00 |

|

Cycle time to correct an invoice error |

7 days |

3 days |

|

Number of invoice line items processed per FTE |

21,232 |

46,667 |

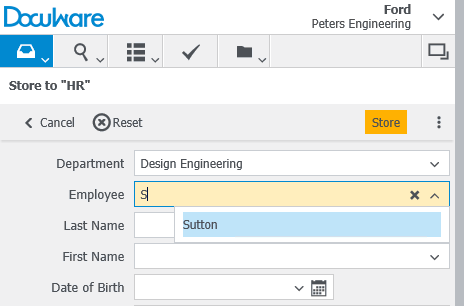

Here’s why manual and paper processes are so debilitating. When an invoice arrives in your accounts payable department, it needs to be approved by the person who ordered the goods and services before you pay the invoice. For the greatest efficiency and cost savings, you’d want to route the invoice in such a way that it gets approved and paid as quickly as possible, with no lag time. When your approval process is rapid, organizations with a strong cash position are able to take advantage of early payment discounts, a savings of perhaps 2 to 3 percent.

But this level of invoice management efficiency is difficult to achieve when you’re routing paper invoices. It’s easy for an invoice to sit in an approver’s inbox for a week, or go missing altogether, resulting in additional employee hours and missing out on early payment discounts. With the digital workflows, available through an ECM system, however, documents move through your organization as efficiently as possible, responding automatically to any obstacles that arise.

The Aberdeen Group notes that bottom performing organizations capture only 18 percent of early payment discounts. Top performing organizations, on the other hand, capture 90 percent of early payment discounts — nearly twice the industry average. Automated accounting processes start with a focus on the accounts payable process and invoice management.

2. Audit documentation

Everyone, especially the Finance department, loves the annual audit. Not.

If you have a paper-based system, an audit is often an ordeal for the accounting department as well as the auditor. The auditor might ask to see all of your invoices from 2015, for instance, so you’d give them access to your filing cabinets and the auditor would sit in a room and wade through all of the documents. With a document management system for managing accounting documents, your accounting department is better prepared for an audit, allowing you to respond quickly to auditor requests and maintain greater control over your business information.

In addition, accounting documents, data and financial information are often highly confidential, and it’s important to be able to see who accessed what accounting documents -- and when. That’s especially true for publicly-traded companies. To comply with the Sarbanes-Oxley Act of 2002, companies need a highly-detailed audit trail that’s only possible through document management. Electronic audit trails put safeguards in place that protect your company and employees. It ensures that you have a record of who is accessing accounting and financial records, helping to determine responsibility in the event of a fraud allegation or other confidentiality issue.

Poor records management can lead to a disastrous audit for you and your organization. Think about the time wasted digging through paper files stored in filing cabinets that may not even be on site. And that’s before the audit even begins. If your paper files are incomplete or messy, your time with the auditor could stretch on for days. However, if you eliminate the clumsy paper-based processes in your organization with digital records, you will be more prepared. With the right records management solution, your audit will be streamlined because you have everything you need at your fingertips.

3. Procurement and purchasing

Procurement includes the processes by which business requirements are translated into supplier requirements; how supplier relationships are managed; and ultimately the ordering of goods and services needed to produce a product. Internal procurement processes are engulfed in masses of documents and paperwork, in incompatible files, formats, and systems. Eliminating paperwork in managing this information is a critical first step in process improvement.

Here are some examples of the kinds of content that must be managed:

- Forecasting sheets, supplier information, product research documents, and regulatory information used internally in the planning stages of building supplier relationships.

- Requests for quotation documents (RFQs), inspection sheets and approval documents, that map against the process by which suppliers are initially identified, audited, and approved.

- Contracts, orders, purchase orders, estimates, correspondence used to place an order with a supplier.

- Manufacturing documentation, supplier data, bills of lading, freight bills, proof of delivery, invoices, correspondence that are used to track an order.

- Functional testing reports, inspection reports, supplier quality data, materials data, defect reports, and defect resolution workflows used to determine whether an order met the original set of requirements.

4. Monthly close process

Once some of the core baseline processes outlined above have been automated, organizations should focus on incorporating these improvements into an accounting department-wide effort to streamline the monthly close process. As the monthly close process is streamlined, cycles are freed within the finance department to think more strategically about the implications of the numbers they are reporting rather than just the numbers themselves.

Speed itself is not the only reason to focus on dramatically improving the monthly close process. According to AICPA, “Speed and accuracy are a constant challenge for those involved in the month-end close process. Many organizations are seeking information at an accelerated pace. But they also need to be able to trust the data they’re acting on. In a recent survey by software provider Adra Match, just 28% of respondents said they trust the numbers reported in the month-end close. At the same time, 90% said they are under pressure to close faster. Meanwhile, just 39% said they are satisfied with the quality of the closing process.

In all of the above processes, it is important to note two key considerations:

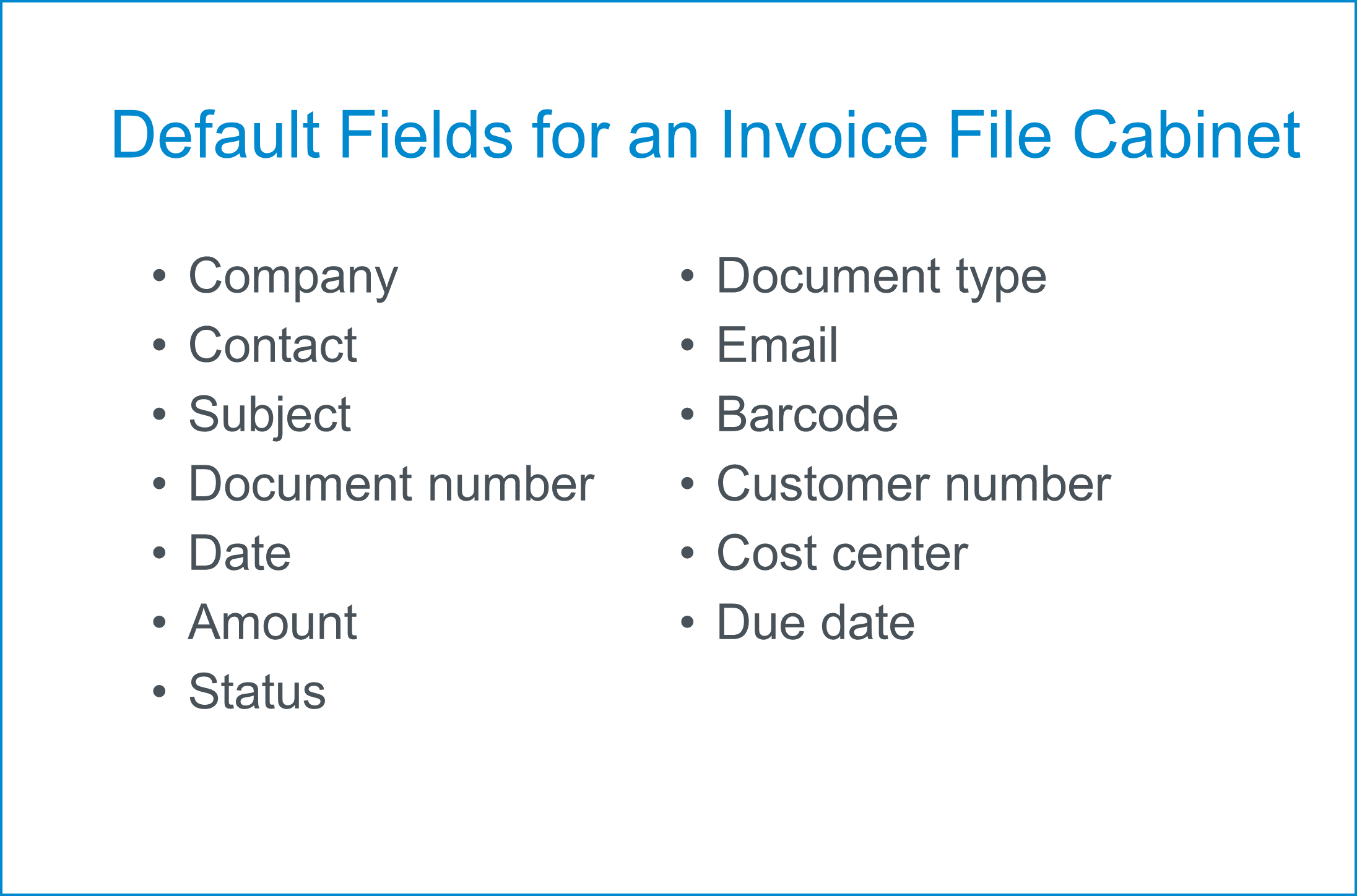

- Whatever document management solution you choose, it needs to easily integrate with the financial, accounting, and ERP systems that run the financial operations of the organization. A document management decision is not just a question of how and where electronic documents are stored; your objective is to automate the process.

- These processes – and a host of other processes both within finance and tied to financial process – overlap. Thus, beware of point solutions that solve a single point of process pain, but leave you exposed to great pain across processes.

You need to start somewhere. If I’ve seen organizations make one mistake over and over again, it’s that they analyze this stuff to death. At this point, you almost have to take it as an article of faith that getting rid of paper and automating processes is good for your business, your customers and your bottom line. Then pick a solution and get started. These aren’t solutions that are so expensive that you can’t afford to make a mistake.