By Claudia Goebel • February 15, 2017

France: Single E-Invoicing Format" title="Germany and France: Single E-Invoicing Format" caption="false" data-constrained="true" width="250" srcset="http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=125&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 125w, http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=250&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 250w, http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=375&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 375w, http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=500&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 500w, http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=625&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 625w, http://blog.docuware.com/hs-fs/hubfs/blog-images/Product_blog/Januar_17/Gemeinsames_E_Rechnungsformat_DE_EN.png?t=1489434989070&width=750&name=Gemeinsames_E_Rechnungsformat_DE_EN.png 750w" sizes="(max-width: 250px) 100vw, 250px"/>Starting March 2017, there will be a German-French standard for electronic invoices. Key regulatory groups from the two countries agreed on this at their last meeting in December 2016. This hybrid accounting format is intended to make it easier for small and medium-sized enterprises to go cross-border with their electronic billing.

This spring there will be a German/French e-invoicing format, which will also have a common name.

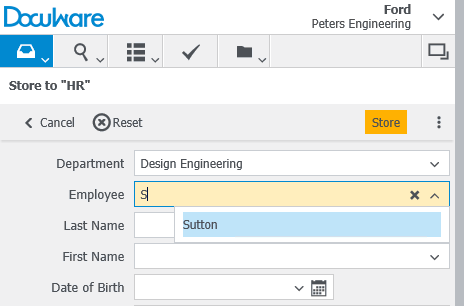

The standard they opted for is a hybrid format which, like the German ZUGFeRD standard, is based on the format PDF / A-3 with embedded XML data. Five common profiles have been defined: M, Basix WL, Basic, Comfort and Extended.

Documentation in German, French and English is in the works and will be distributed to help answer questions about how the new format can be used within each country’s national context.

This new standard was created by two organizations: the German Forum for Electronic Invoicing (FeRD) and the French Forum National De La Facture Electronique (FNFE). They in turn were supported by the ministries of their countries.

Germany and France have both incorporated EU Directive 2010/45 into their respective national VAT laws. So these same conditions are basically being applied for electronic invoices:

• Electronic invoices are deemed equivalent to paper invoices.

• Taxable companies are responsible for the organization of their internal controlling procedures.

• Electronic signatures or EDI procedures are optional in both countries.

Topics: News, Invoice management